AB Bank Student Account 2025: Benefits & Opening Guide

AB Bank can be a good option for students to manage their banking needs. Whether you are 18 years old or younger, students can open a student account at AB Bank.

Below are the benefits, requirements, application process, and other important details about AB Bank’s student account.

Benefits of AB Bank Student Account

First, let’s learn about the benefits of AB Bank student account. With a low minimum balance deposit, you get:

- No monthly maintenance fee for the account.

- Free internet banking, allowing you to manage your account from your mobile phone.

- A free dual currency MasterCard, which you can use to make purchases both inside and outside the country.

- Checkbook facility with the student account.

- Free fund transfers and mobile recharge services.

- AB Bank also offers various additional benefits based on your savings and transactions.

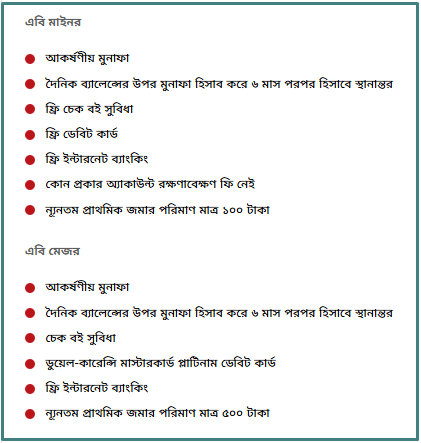

AB Student Account Types

AB Bank offers two types of student accounts:

- AB Major Account for students who are 18 years or older.

- AB Minor Account for students under 18 years old. For the minor account, a guardian must manage the account until the student turns 18.

Eligibility

To open a student account at AB Bank, the student must meet the following criteria:

- Must be a full-time student.

- Must be a Bangladeshi national.

- Must provide proof of being a student, such as a student ID card or a certificate from the head of the educational institution.

Requirements to Open a Student Account at AB Bank

The documents needed for AB Bank’s student account depend on the type (AB Major or AB Minor). Below are the required documents for each type. You must bring these documents when applying.

AB Major

- For AB Major student account, you will need:

- NID card or birth certificate or passport.

- Photocopy of current student ID card or a certificate from the head of your institution.

- If you have any source of funds as a student, documents related to that source.

- Two recent passport-size photos of the student.

AB Minor

- For AB Minor student account, you need to bring:

- Photocopy of student’s NID card, passport, or birth certificate.

- Student ID card or a certificate from the head of the institution.

- Photocopy of the guardian’s NID card, passport, or birth certificate.

- Recent passport-size photos of both the student and the guardian.

Additionally, if AB Bank asks for extra documents during the application, you must provide them. For example, a utility bill or other proof of address.

AB Bank Student Account Opening Process

Now, let’s see step-by-step how to open an AB Bank student account. First, collect all the required documents mentioned above. Then follow these instructions:

- Take all the documents and visit your nearest AB Bank branch.

- Go to the account opening section and inform them you want to open a student account.

- They will give you an application form. Fill it out correctly based on your documents.

- Submit the completed form along with all documents at the account opening desk.

- They will process your application and open the account. Activation may take 2–3 days.

- Once your student account is approved, the bank will contact you. They may send mail to your address, call your phone, or email you, so provide your correct address.

- After receiving the activation mail, visit the branch again, deposit the minimum balance, and start using your account.

Learn also about the Islami Bank Student Account

Minimum Deposit

To open a student account at AB Bank, a minimum deposit is required.

- If you are over 18 and applying for an AB Major account, you need to deposit at least 500 BDT.

- For an AB Minor account, the minimum balance is 100 BDT.

However, you cannot withdraw this minimum balance. You can deposit more than this amount, and the extra money will be available in your account for withdrawal.

Debit Card and Cheque Book

After your student account is approved by the bank, you will receive a dual currency debit card.

If you want a cheque book, you need to pay an extra fee for it. You can collect the cheque book from the branch or request the bank to mail it to your address.

AB Student Account Interest

AB Bank provides interest on savings for students. The bank offers an annual interest rate of 3.25% for student accounts.

If your account balance is low, interest may not be applied.

AB Bank Student Account Validity

Knowing the validity of the AB Bank student account is important. The account is valid up to a maximum age of 25 years.

Before you turn 25, you must contact the bank.

The bank will convert your student account into a regular savings account. Once converted, you will no longer receive the benefits of the student account.

Transaction Limit

There are no restrictions on transactions in AB Bank’s student account. You can make transactions daily as needed.

However, with the dual currency card provided, you can withdraw a maximum of 200,000 BDT per day.

Contact Number

For any information about AB Bank student accounts or to resolve any issues, you can directly call the AB Bank hotline at 16207.

If calling from outside Bangladesh, dial +88-09678916207.

FAQs About AB Student Banking

Here are some important questions and answers about AB Bank student accounts:

Can I open an AB Bank student account online?

No, AB Bank does not offer online account opening for student accounts. You must visit a nearby branch to open one.

Can I open an AB Bank student account from outside Bangladesh?

No, you cannot open an account from abroad. You must visit an AB Bank branch in your own country.

Can I use AB Bank’s dual currency card for international transactions?

Yes, you can use the dual currency card for international transactions.

What is the minimum age to open an AB Bank student account?

For AB Major accounts, the minimum age is 18 years. For AB Minor accounts, the minimum age is between 13 to 14 years.