bKash to Bank Fund Transfer Guide, Charges & Limit in 2025

At various times, we may need to transfer money from our bKash account to a bank account.

Whether it’s due to a shortfall in the bank account or for saving purposes, we often transfer money from bKash to a bank account.

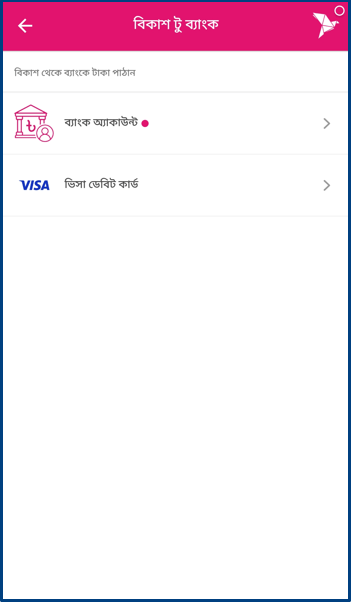

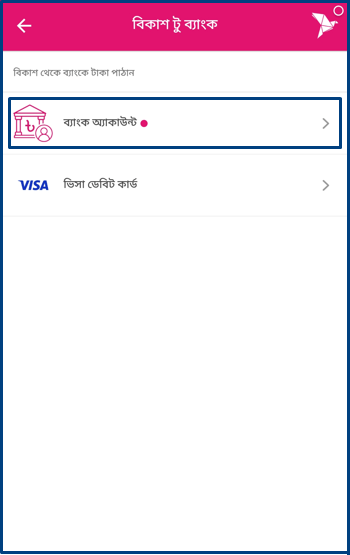

There are two methods for transferring money from bKash to a bank account: one is by directly transferring to a bank account, and the other is via a Visa debit card.

Below is detailed information and the procedure for transferring money from bKash to a bank account.

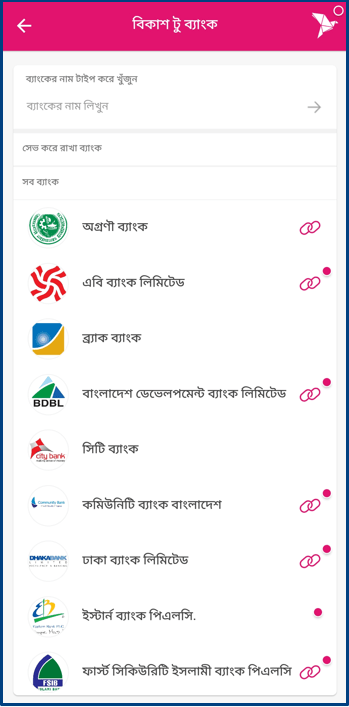

Which Banks Allow Direct Money Transfer from bKash

Not all bank accounts in Bangladesh can receive direct transfers from a bKash account. bKash authorities have specified certain banks that support this service.

These banks are:

- Agrani Bank

- AB Bank Limited

- BRAC Bank

- Bangladesh Development Bank Limited

- The City Bank

- Community Bank Bangladesh

- Dhaka Bank Limited

- Eastern Bank PLC

- First Security Islami Bank PLC

- IFIC Bank PLC

- Midland Bank Limited

- Mutual Trust Bank Limited

- NRBC Bank

- Prime Bank

- Pubali Bank Limited

- Rajshahi Krishi Unnayan Bank

- Sonali Bank

- Southeast Bank Limited

- Premier Bank PLC

- Trust Bank Limited

Apart from these banks, it is not possible to transfer money directly from a bKash account to any other bank account.

How to Transfer Money from bKash to Other Banks

Besides the banks mentioned above, if you want to transfer money to any other bank, you can do so using the Visa debit card connected to your bank account.

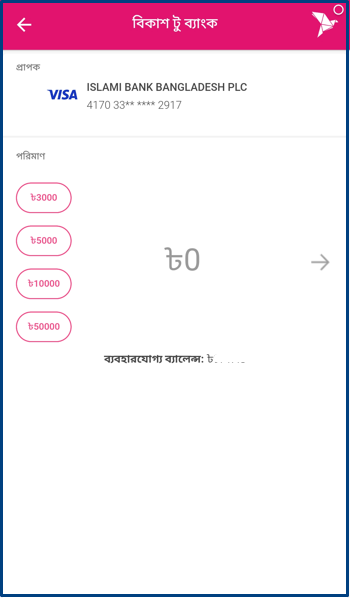

For example, it is not possible to transfer money directly from a bKash account to Islami Bank, but you can transfer money from a bKash account using the Visa debit card of an Islami Bank account.

Additionally, for banks that allow direct transfer from bKash, you can also transfer money using their Visa debit cards.

So, simply put, you can transfer money from bKash to any bank account through its Visa debit card.

Requirements for Fund Transfer from bKash

To transfer money from bKash to bank account, if you want to transfer directly to an available bank account, you will need the bank account number and the account holder’s name.

On the other hand, if you want to transfer money to any bank using a Visa debit card, you will need the Visa debit card number.

bKash Account to Bank Account Fund Transfer Through Visa Card

Let’s first learn how to transfer money from a bKash account to your bank account using a Visa debit card. To do this, collect your Visa debit card number and follow the steps below:

- First, log in to the bKash app from your phone.

- Then, from the home page, click on the “bKash to Bank” option.

- Two options will appear here one is “Bank Account” and the other is “Visa Debit Card.”

- Here, we are presenting the method of transferring money using the Visa debit card.

- So, click on the “Visa Debit Card” option.

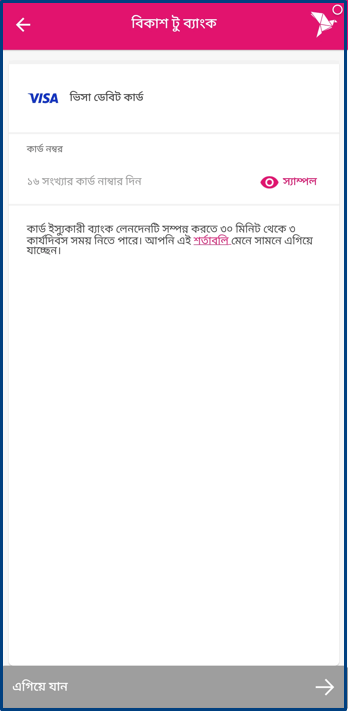

- On the next interface, there will be an option to enter the Visa debit card number.

- Enter your Visa debit card number here.

- After entering the Visa debit card number, press the “Continue” button.

- On the next interface, provide the amount you want to transfer.

- Then press the “Continue” button again.

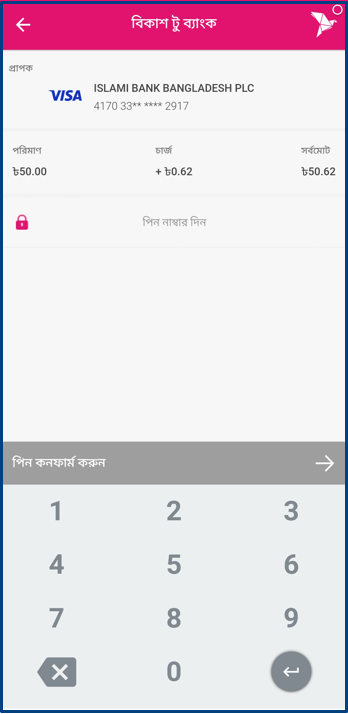

- After that, provide your bKash account PIN and submit, and the money will be transferred to your account.

Direct Bank Transfer from bKash

Apart from using a Visa debit card, you can also transfer money directly to a bank account. Follow the procedure below to do this.

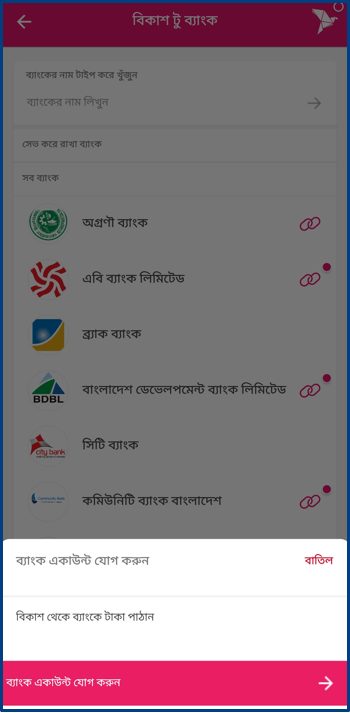

- Go to the bKash to Bank option from your bKash account and select the Bank Account option.

- Then, the list of banks eligible for transfer will be displayed.

- From there, select the bank to which you want to transfer the money.

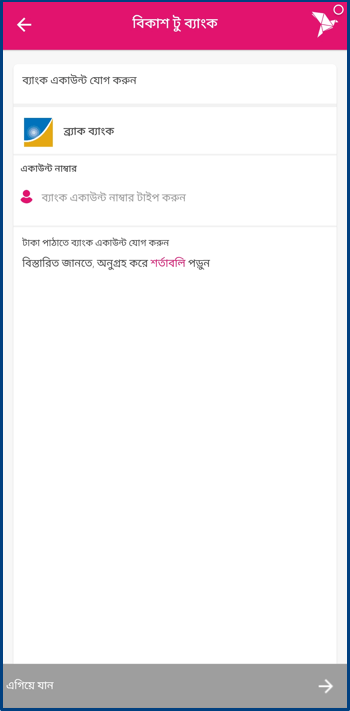

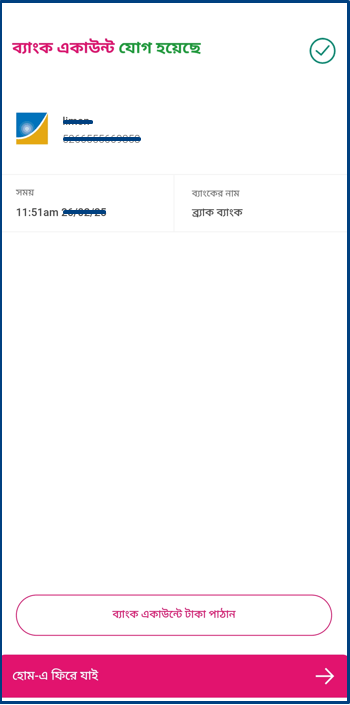

- To make the transfer, you first need to add that bank account to your bKash account.

- Select your desired bank, and on the next page, enter the bank account number where you want to send the money.

- After that, provide the name of the bank account holder.

- Once you submit this information, the bank account will be added to your bKash.

- However, keep in mind that the mobile number linked with the bank account and the mobile number registered with your bKash account must be the same.

- Once the bank account is added, go back to the home page, select the bKash to Bank option again, and choose your bank. The saved bank account will be shown there. Press on it.

- On the next page, enter the amount you want to transfer.

- Then press Continue, and finally, enter your bKash PIN and submit. The money will be transferred.

How Long Does it Take to Transfer Successfully?

If you transfer money from your bKash account via Visa debit card, the transfer will happen instantly. As soon as the money is transferred, you will receive an SMS from the bank confirming the transaction.

On the other hand, if you are transferring money directly to a bank account, it may take some time to complete. However, it may take up to three days.

bKash to Bank Transfer Charge

Whether you’re transferring money from a bKash account to a bank account directly or via a debit card, certain charges apply for both methods. Below is the information regarding these charges:

| Methods | Amount BDT | Charges |

| Visa to Visa | 50-25,000 | 1.25% |

| Visa to Visa | Above 50,000 | 1.49% |

| Direct Bank to Bank | Any Amount | Varies by Bank |

When transferring money directly from a bKash account to a bank account, the charges vary depending on the bank.

For example, Agrani Bank PLC and Sonali Bank PLC apply a lower charge of 1.00%.

Brac Bank PLC charges slightly more at 1.15%. A higher standard rate of 1.25% is charged by other available banks listed above.

Limitations for Transferring Money from bKash to Bank

Now let’s look at the limitations for transferring funds from a bKash account to a bank account. Here is a table for the information.

| Category | Limit |

| Per Transaction | Min- 50 BDT Max- 50,000 BDT |

| Daily Limit | Up to 50 Transactions Max- 50,000 BDT Daily |

| Monthly Limit | Up to 100 Transactions Max- 300,000 BDT |

If you feel any issue related to transferring money from bKash to Bank, just submit a comment your issue, we are here to fix your issue. Thank you.