Islami Bank Student Account 2025: Features & Opening Guide

Islami Bank is quite popular among students in Bangladesh for student banking.

Students especially prefer Islami Bank because of its many benefits and the halal interest system.

I also have a student account with Islami Bank, which I still use. I opened this account easily from home using the CellFin app.

Below is detailed information about the Islami Bank student account and how to open it.

Benefits of Islami Bank Student Account

Let’s first look at the main benefits and features of the Islami Bank student account:

- You only need to deposit 100 Taka as a minimum to open the account.

- There is no monthly maintenance fee for the student account.

- Right after opening the account, you get a Visa debit card without any monthly charges.

- For international transactions, you can apply for a Master debit card, but there will be a monthly fee for the international card.

- You can open the Islami Bank account online by yourself using the CellFin app, and do transactions through online banking.

- There are no charges for SMS notifications or transaction queries; these services are completely free.

- Additionally, based on your savings and transactions, Islami Bank gives bonuses and other benefits to students at different times.

Who Can Open a Student Account at Islami Bank?

The student account is only for eligible students. Not everyone can open this account. To open a student account, you must meet these eligibility criteria:

- You must be a Bangladeshi citizen and a student.

- Your age should be at least 18 years and below 30 years.

- To prove you are a student, you need to provide a student ID card or a certificate from the head of your institution.

What Documents Are Needed to Open a Student Account at Islami Bank?

When you open the Islami Bank student account, you must submit some documents, whether online or at the branch.

Here is a list of required documents:

- Student ID card. If you don’t have one, then a certificate from the head of your institution is needed.

- NID card, passport, or birth certificate.

- Two recent passport-size photographs.

- A copy of the NID card and one passport-size photo of the nominee you choose.

- A proof of address, like a photocopy of a tax or utility bill (electricity bill, water bill, or gas bill).

Currently, these documents are needed. Sometimes the bank may ask for extra documents, which you will need to provide.

How to Open the Account

You can open an Islami Bank student account in two ways:

- Open the account yourself online using the CellFin app.

- Go directly to your nearest Islami Bank branch and open the account in person.

Below, both methods are explained.

How to Open an Account by Visiting the Branch

The easiest and simplest way to open an account is by going to the branch in person. Before visiting the branch, collect all the documents mentioned above and then go to your nearest Islami Bank branch.

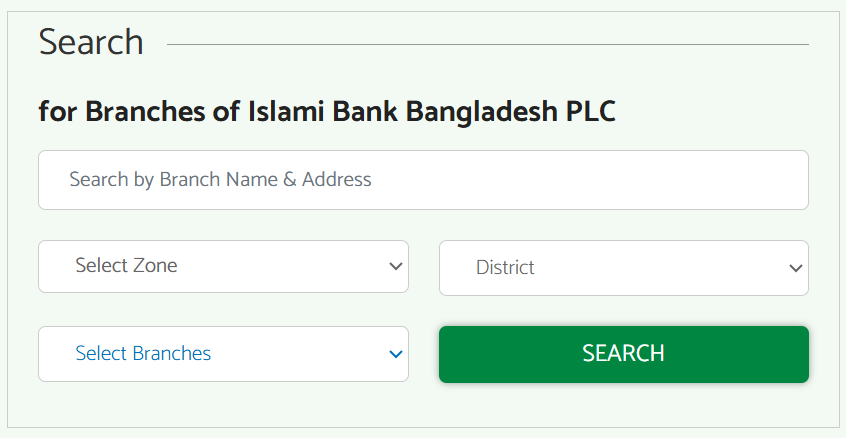

- To find the address of the branch nearest to you, visit the Islami Bank Branch Location webpage.

- After entering the branch, first go to the help desk and ask where you can open an account.

- Then, at the account opening desk, they will give you an account application form.

- This form has several steps, and you must fill out all of them correctly. If you have any problems or don’t understand any step, ask the help desk for assistance.

- Once the form is completed, submit it along with your documents at the account opening desk. Then your account opening process will begin.

- The process can take up to 30 minutes. After your account is opened, you will receive a receipt for the minimum deposit.

- Finally, go to the deposit counter, pay the minimum deposit, and your account will be opened. You can start using your account right away.

How to Open an Islami Bank Student Account Online

If you don’t want to visit a branch, you can open an account using the CellFin app on your phone.

- To open the account through the CellFin app, you will need your NID card and the nominee’s ID card.

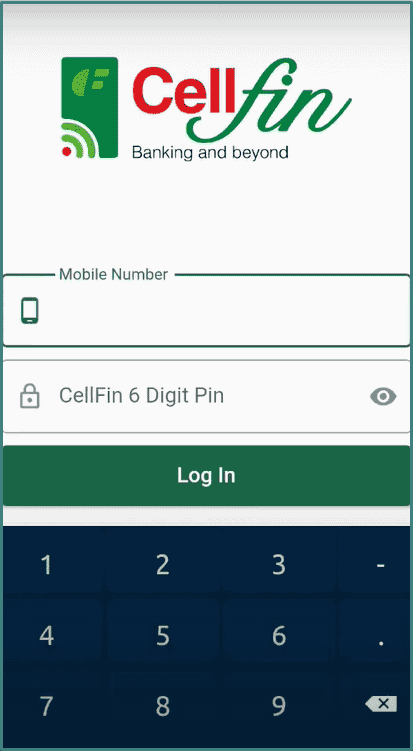

- Before opening an account via CellFin, you must register on the CellFin app first. For a complete guide on registering, visit the CellFin registration guide page.

- Once you have successfully registered on CellFin, log in to the app.

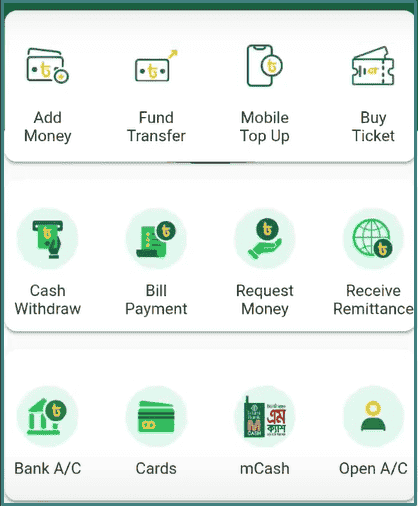

- After logging in, click on the “Open AC” option from the home page.

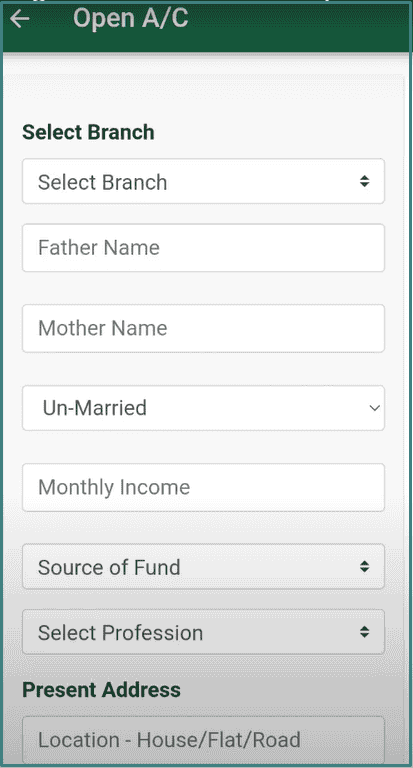

- In the next interface, first select the branch based on your location.

- Then fill in your father’s name, mother’s name, and other required information correctly.

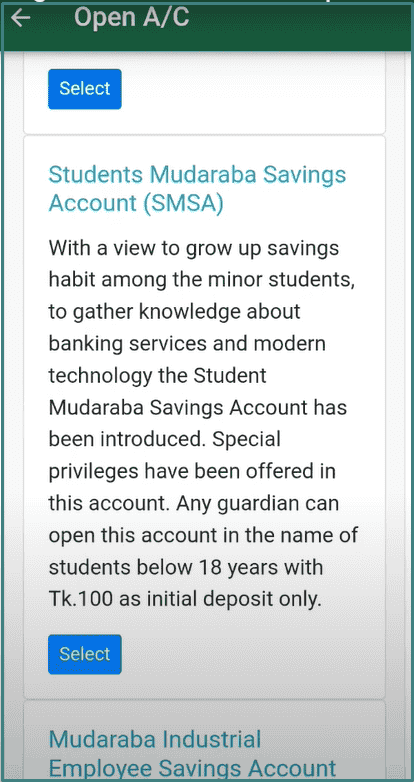

- Next, select the type of account you want to open.

- Since you are opening a student account, select the “Student Mudaraba Savings Account” option.

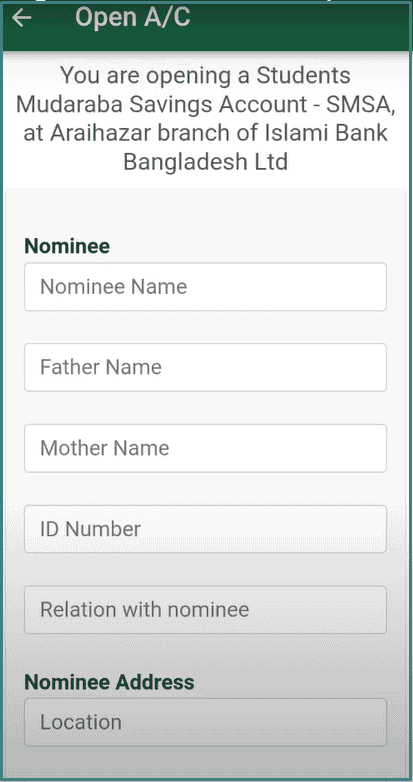

- On the next page, provide the nominee’s details, such as nominee’s name, parents’ names, ID card number, and other information.

- Then click the “Confirm” button.

- In the following interface, upload pictures of the front and back of the nominee’s ID card.

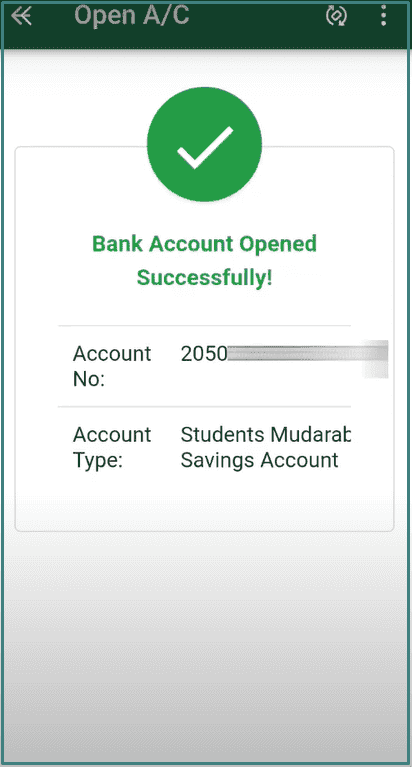

- After clicking “Confirm,” your account will be opened.

- After opening the account, you must visit the selected Islami Bank branch to activate it.

- Once you deposit the minimum balance, your account will be activated.

How Much Does It Cost to Open a Student Account?

To open an Islami Bank student account, a minimum balance of only 100 taka is required. However, you can deposit more if you want.

After opening the account, you will receive a receipt for the minimum deposit from the account opening desk. Take this receipt to the deposit counter and deposit the amount.

If you order a checkbook, you will need to pay extra based on the number of pages in the checkbook.

How to Get a Checkbook and Debit Card for Your Student Account

As a student account holder, you can withdraw and deposit money using an ATM. After opening your account, the bank will immediately give you an ATM card, which is basically a Visa card.

If you want a student Visa card with your name printed on it, you must inform the bank at the time of account opening. They will provide you the named Visa card within 15 days.

If you need a checkbook for your student account, you must also request it. Usually, each page of the checkbook costs 5 taka.

For example, if you want a 10-page checkbook, you need to pay 50 taka extra on top of the 100 taka minimum deposit. If you want a 20-page checkbook, you will need to pay 100 taka extra.

Interest Rate on Islami Bank Student Account

Islami Bank follows a halal interest system. This means they do not pay you direct interest but invest your deposited money.

Then, they share the profit earned from the investment with you. For student accounts, this profit share is given twice a year.

There is no direct interest mentioned for the student account; the profit share is given based on different factors.

Validity and What to Do After the Student Account Expires

The maximum age limit for a student account is 30 years. After turning 30, your student account will automatically be converted into a regular savings account.

Alternatively, you can inform the bank before turning 30.

Once your account converts to a regular savings account, you will no longer receive student account benefits.

After conversion, you will have to pay different fees, just like a regular savings account.

Transaction Limits of the Student Account

Islami Bank’s official website does not clearly mention the exact transaction limits for the student account. You need to ask the bank directly how much money you can transact daily or monthly.

Generally, you can make transactions up to 100,000 taka per day. Since you are a student, the bank may ask you some questions if you try to transact a large amount.

FAQs About IBBL Student Account

Here are some important questions and answers about Islami Bank’s student account to help you understand better:

Can I open a student account while living abroad?

If you are a Bangladeshi living abroad, you can register your account through the CellFin app. But to activate the account, you must visit an Islami Bank branch in your home country.

Can I open a student account if I am not a student?

No, to open a student account, you need to provide a student ID card or a certificate from your institution’s head. Without these, you cannot open the account.

Can I open a student account before turning 18?

No, the main rule is that the student must be at least 18 years old to open a student account.

Can I have both a student account and a savings account in Islami Bank at the same time?

Yes, if you are eligible, you can open and operate both a student account and a savings account simultaneously.

How can I contact Islami Bank’s customer care?

Call 16259 from within Bangladesh or (+880)-2-8331090 if you are calling from abroad.

![How to Change/Reset CellFin Account PIN [2025 Updated Guide]](https://bdorion.com/wp-content/uploads/2025/05/Upay-Account-Opening-Guide-10-1-768x402.jpg)