Online VAT Registration in Bangladesh: A Step-by-Step Guide

In Bangladesh, various business or service-providing entities are required to register for VAT depending on certain conditions.

If the necessary conditions apply to you, you must register for VAT to avoid legal complications. Generally, VAT registration can now be done online.

Below, step-by-step information is provided on how to register for VAT online, what documents are required, who falls under the scope of VAT registration, and other related information about VAT.

What is VAT?

The full form of VAT is Value Added Tax. It is an indirect tax imposed on various products and at every stage of the sales process. However, it is usually borne by the consumers.

To explain it simply, when you go to buy a product, the price charged from you includes an indirect tax. You purchase that product with the tax included.

This indirect tax is essentially VAT or Value Added Tax. Currently, VAT is imposed in Bangladesh at a rate of 15%, although the rate may vary for different products.

Why is VAT registration required?

VAT is a legal obligation of the National Board of Revenue in Bangladesh, from which the government earns a significant portion of its revenue.

Therefore, according to government regulations, business entities must register for VAT. If a business entity has VAT registration, it is considered professional and trustworthy.

Moreover, to work with other large companies or government agencies, VAT registration is mandatory, as these organizations require a VAT registration number to conduct business transactions.

Registered businesses can issue VAT invoices, which also ensures transparency with customers.

Who Must Register for VAT?

Let me first clarify who needs VAT registration. In Bangladesh, VAT registration is not mandatory for all businesses or service-providing entities.

However, under certain conditions, VAT registration is required. Below is a brief and clear explanation regarding this.

- Businesses with an annual turnover of 30 million BDT or more must register for VAT.

- All manufacturing businesses, regardless of their turnover or sales amount, must register for VAT.

- Businesses providing services such as IT services, consultancy, event management, etc., with significant income, must register for VAT.

- Any person or organization that imports or supplies goods, especially those working with various companies, must register for VAT.

- Individuals or entities working on government or large corporate contracts must have a VAT number.

How to Register for VAT?

Previously in Bangladesh, VAT registration had to be done through the National Board of Revenue (NBR) office. However, now the process can be completed online from home.

- The first step in VAT registration is to prepare all the required documents.

- If necessary, these documents should be scanned and stored on a device, as they need to be uploaded at one stage of the registration process.

- Next, an online account must be created. Then, the VAT registration application form should be filled out and submitted.

- Once the application is properly completed, the National Board of Revenue of Bangladesh will review your submission.

- Upon verification, the VAT authority will issue an Electronic BIN (e-BIN), which is your VAT registration number.

Below, this process is outlined step-by-step so you can complete VAT registration for your business.

Required Documents for VAT Registration

Before applying for VAT registration, you must have the necessary documents ready. These include:

- Trade license

- TIN certificate

- National ID card

- Mobile number and email address

- Rental agreement or ownership deed of the business premises

- Bank account information

Complete Procedure for Online VAT Registration in Bangladesh

Now let’s go through the step-by-step process of how to register for VAT online.

One of my elder brothers completed the VAT registration for his business online, and I helped him with it. I’m sharing that process with you step-by-step.

Prepare the above-mentioned documents and follow the procedure below.

Step 1: Creating an Account

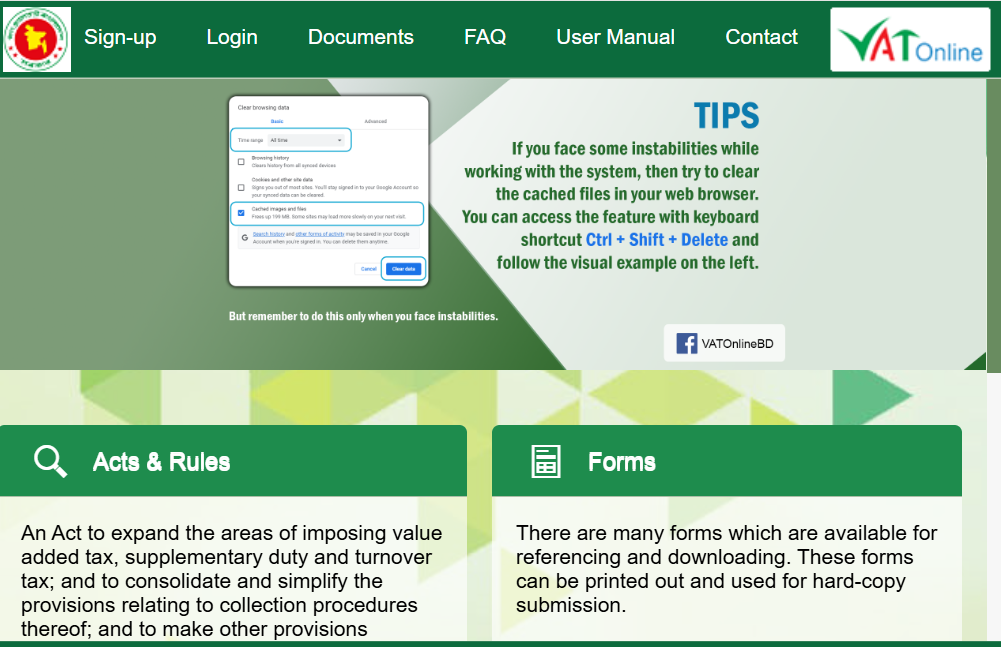

- First, visit the VAT Online Services website.

- On this website, you need to create an account. To do this, click on the Sign Up option from the top menu bar.

- Then, you will be asked to provide some information.

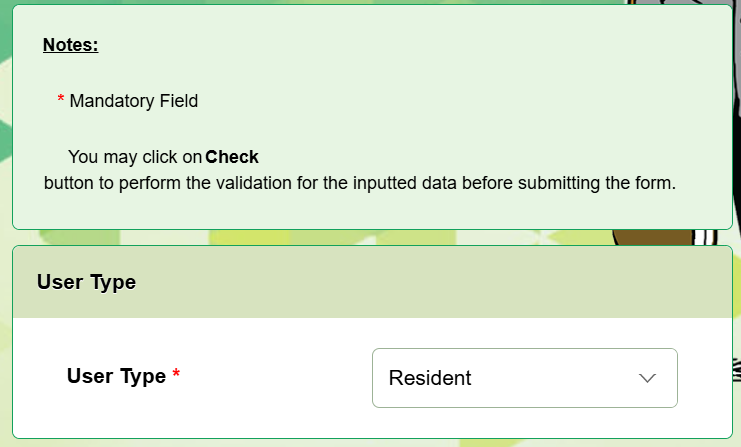

- In the User Type option, if you are operating a business located within the country, you must select Resident.

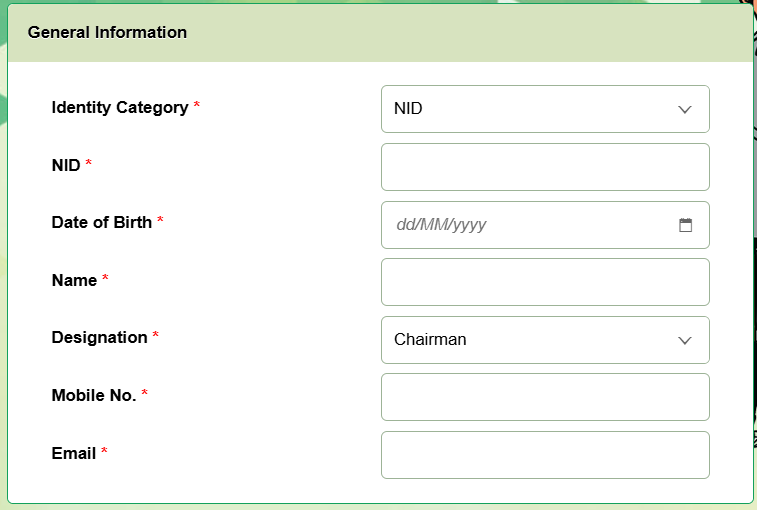

- Next, under the General Information section, select NID in the Identity Category field.

- Then enter your NID Number, followed by Date of Birth, Name, and other required information.

- After that, there will be a box labeled Designation. You have to select the designation you hold in your business organization.

- Then provide your Mobile Number and Email Address.

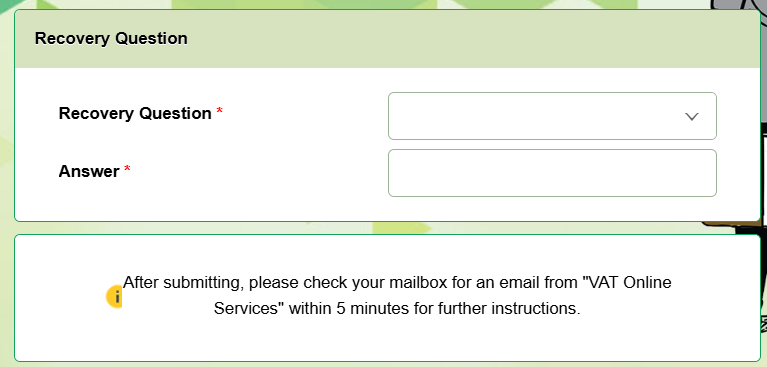

- Next, there is a section called Recovery Question.

- If you ever forget your account password, you can recover it by answering the recovery question.

- Select any question of your choice from the Recovery Question section, and provide an answer of your choice below.

- However, you must remember both the question and the answer.

- After that, review all the information you’ve provided. If everything is correct, click the Submit button.

- Then a Verification Code will be sent to your mobile number. Enter the code in the appropriate field.

- Once the verification code is entered, a temporary password will be sent to your phone and email. Enter this temporary password and press the Login button.

- After that, your next task is to create a new password. Set up a password of your choice, which must be at least eight characters long.

- Then, in the Retype Password field, re-enter the same password you created. After that, click the Change Password button to create your password.

- And that’s it- your account on the VAT Online Services website will be successfully created.

Step Two: VAT Registration

- After creating your account, visit the VAT Online Services website again to proceed with VAT registration.

- Click the Login button and enter your mobile number as the username and your newly created password. Then press the Login button.

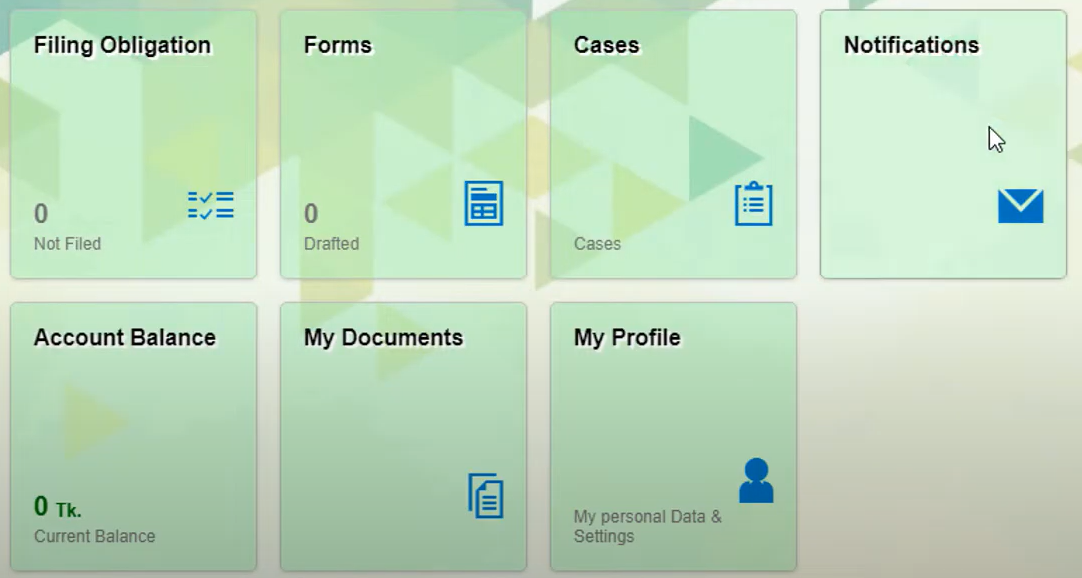

- You will now see a dashboard. From the dashboard, click on the Form option. Here, you will see your Submission ID along with other information.

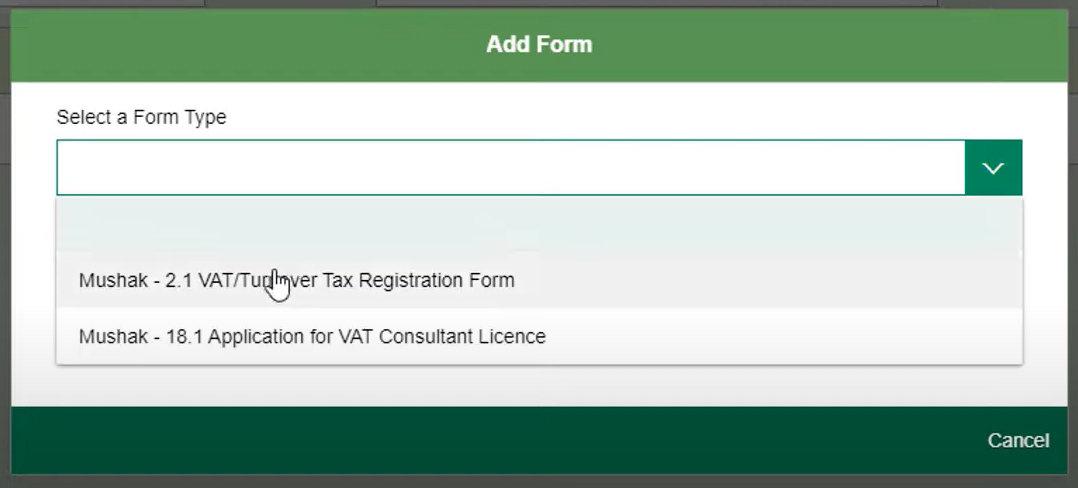

- From the Menu Card, click on the Add Form option.

- Then select MUSAK 2.1 (VAT Turnover Tax Registration Form). After that, press OK.

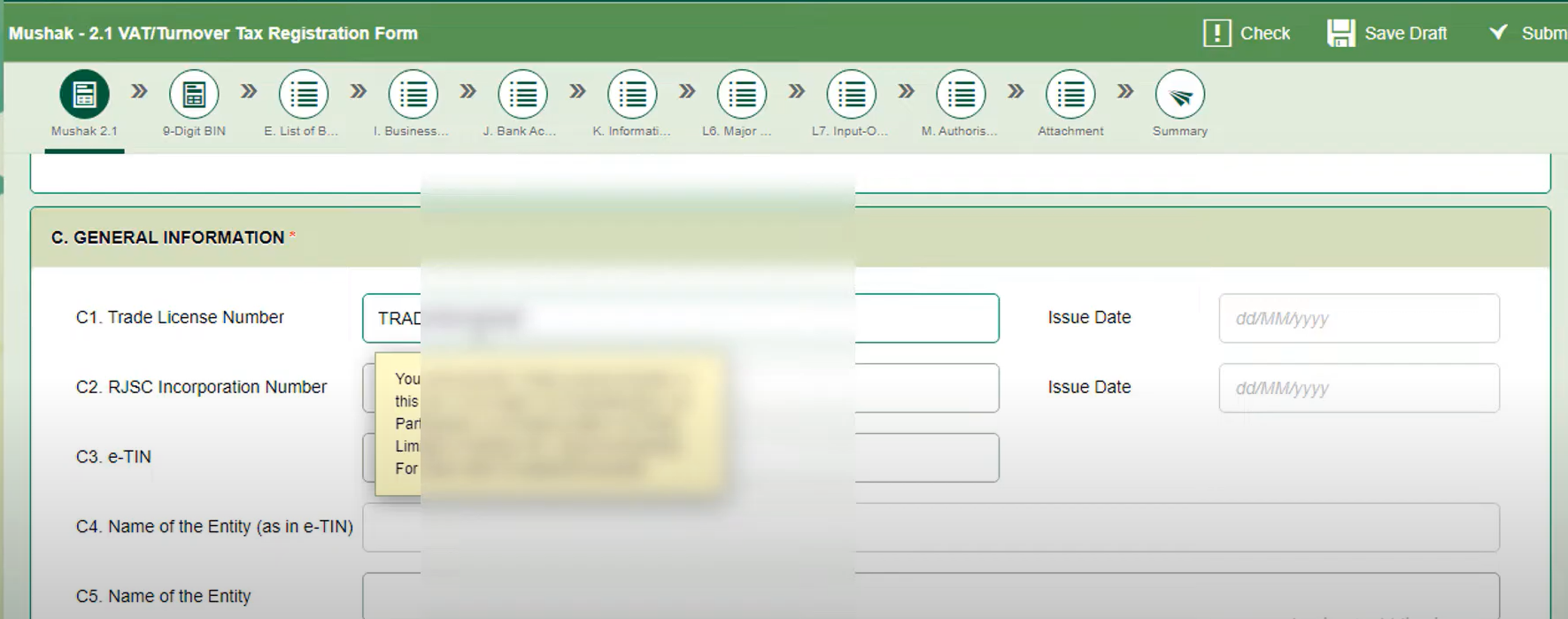

- An application form will then appear. You will be asked to provide several pieces of information.

- Based on the documents mentioned earlier, you need to fill in the details carefully.

- Fill in the details of your business properly- such as what kind of services your business provides, whether it is affiliated with other companies, whether it is 100% locally owned, and the business name and location.

- Provide all these details clearly and accurately. Then fill in your personal information.

- At the very bottom, you will be required to provide your business bank account information.

- Then, in the Attachment section, you will be asked to upload certain documents such as the TIN Certificate, NID, bank statement, and other required papers that were mentioned earlier.

- So, make sure these documents are scanned and ready on your device for upload.

- Afterward, under the Summary section, you will see all the information you have filled in. If there is any mistake, you can correct it, as there is an option to revise.

- Once everything is accurate, click the Submit button.

- That’s it- your online VAT registration will be completed.

What to Do After Completing Online VAT Registration

After completing your online VAT registration, there is generally nothing more you need to do immediately.

Once you have registered online, the VAT authority will carefully verify your submitted information. If everything is accurate, your application will be approved, and you will be issued a VAT certificate.

When and How Will You Receive the VAT Certificate?

After completing VAT registration online, the VAT certificate and a 13-digit BIN (Business Identification Number) are usually sent via email.

If your business is located within Dhaka, it typically takes about 3 to 7 days to receive the certificate.

However, if your business is outside Dhaka or the certificate is not sent by email, then you will need to visit the VAT office and collect the VAT certificate by providing your application ID.

Do You Need to Renew VAT Registration?

No, once you have registered for VAT, you do not need to register or renew it again.

However, if at any point you need to update any information such as your business name, type, address, or ownership, you must update those details as soon as possible.

What If You Want to Close Your Business?

If you decide to close your business, you must cancel your BIN number. If you do not cancel it, the BIN will remain active, and you will be required to continue submitting VAT returns regularly.

To cancel your BIN online, you can apply through the VAT Online Services website.

Is There Any Fee for VAT Registration?

No, there is no government fee applicable for VAT registration.

However, if you go to a cyber café or any other service provider to apply for VAT registration, they might charge you a small fee. But this is not a government fee, it is simply their service fee.

If you apply by yourself following the method I’ve shown, you won’t need to pay any fee. You will receive a VAT registration certificate completely free of charge.

Information About Submitting VAT Returns

Once your VAT registration certificate is issued, you will be required to log in to the VAT Online Services website every month and submit your VAT return using the VAT Return Filing section.

There, you will find Form 9.1, where you need to provide information such as your monthly sales amount, VAT collected, VAT balance, etc. You can then make the payment online via A-Challan (payment slip).

VAT returns for any month must be submitted within the first 15 days of the following month.

If you fail to submit your VAT return on time, you will have to pay a late fee of BDT 100 to BDT 500 per day, depending on the delay.

If you have no sales in a particular month, you still need to submit a Nil Return.